EST Sector Funding Directory

Propulsion Québec has launched a major funding initiative to study and mobilize the ecosystem of companies and financial players in the EST sector. The project seeks to assess and document the state of the funding chain, better understand the funding needs of businesses wishing to secure their growth, and identify sources of local and international funding for the Electric and Smart Transportation (EST) sector.

This project has helped:

- form the basis of a strategy and action plan to tackle funding challenges in the EST sector

- create a directory of funding sources available to EST companies according to stage of growth and technology readiness

This comprehensive funding directory is updated regularly with funding sources to ensure Quebec EST businesses have ready access to the information they need.

This project was made possible thanks to the financial support of the Government of Quebec, Caisse de dépôt et placement du Québec, Desjardins Group, MacKinnon, Bennett & Company, Investissement Québec, Fondaction and Langlois Lawyers.

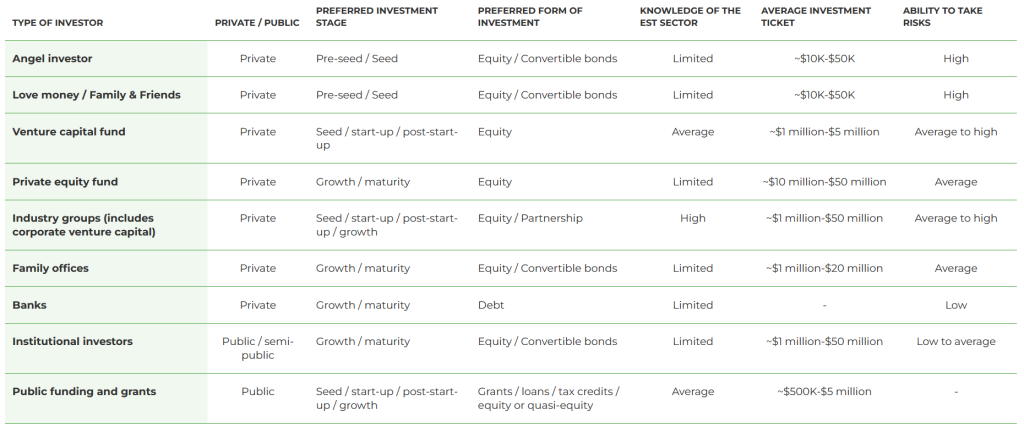

Major funding categories1

There are about 10 main types of investors active in Quebec’s EST sector, as per the table and diagram below:

1 There is no public funding program currently reserved exclusively for the EST sector or for mobility, but companies in this sector are eligible for programs based on certain features of EST (GHG reduction, innovation, manufacturing, etc.)

Non-exhaustive list of leading private and institutional Quebec investors active in EST

Some 20 Quebec investors are now active2 in EST in Quebec, representing mainly four types of investors (venture capital, private equity, institutional investors, and public investment).

The angel network in Quebec is mainly organized around Anges Québec and supported by the Ange Québec Capital fund (funded by Investissement Québec, CDPQ, FSFTQ, and members of Anges Québec).

Below is a non-exhaustive list of leading Quebec private (venture capital / private equity) and institutional investors3 active in Quebec’s EST sector:

2 Have already invested or are actively looking for opportunities

3 Includes some investors initially based abroad but with a direct and significant presence in Quebec

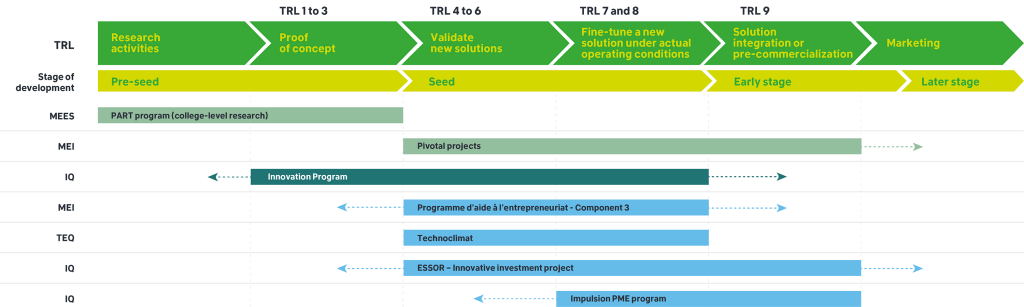

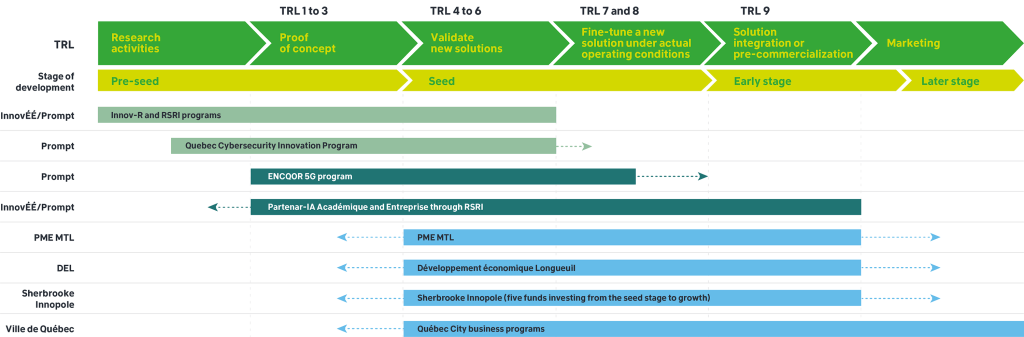

Quebec public funding and grants available to EST businesses

Many public funding programs and grants are also available at the municipal level or from government-related corporations, a number of which are particularly well suited for EST businesses.

The following diagram shows the programs most relevant to the EST sector and indicates the technology readiness level (TRL4) and stage of development5 they address:

4 The different levels of readiness are detailed in the Appendices of the full report

5 The different stages of development are detailed in the Appendices of the full report

*Technology readiness level: system og mesurement used to evaluate the readiness level of a technology.

The details for each program shown in the above diagrams are as follows:

- Managed by : MEES

- Financing type : Grant

- Amounts granted : Maximum of 50% of eligible expenses

- Main criteria : This program is available to educational institutions that partner with companies to develop technologies.

Pivotal projects

- Managed by : MEI

- Financing type : Grant

- Amounts granted : ~$15 million for EST

- Main criteria : Not specified

- Managed by : IQ

- Financing type : Grant and loan

- Amounts granted : Between $50K and $350K / Maximum of 50% of eligible expenses

- Main criteria : Minimum of 20% of total project cost contributed by private sources and required R&D effort

- Managed by : MEI

- Financing type : Grant

- Amounts granted : Between $25K and $150K

- Main criteria : Must receive support from a business incubator or accelerator

- Managed by : TEQ

- Financing type : Loan

- Amounts granted : Maximum of $3 million / Maximum of 50% of eligible expenses

- Main criteria : Pre-commercial innovation or clean technology testing

- Managed by : IQ

- Financing type : Multiple options

- Amounts granted : Not specified / Maximum of 50% of eligible expenses

- Main criteria : Have eligible expenses of at least $100K

- Managed by : IQ

- Financing type : Equity or quasi-equity

- Amounts granted : Between $250K and $1 million / Maximum of 50% of eligible expenses

- Main criteria : Have at least one client and market validation. The business must not have completed an initial marketing and financing round greater than $250K.

- Managed by : IQ

- Financing type : Equity or quasi-equity

- Amounts granted : Between $50K and $1 million

- Main criteria : Have a sound financial and operational structure

- Managed by : MTQ

- Financing type : Grant

- Amounts granted : Maximum of $1 million / year

- Main criteria : Not specified

- Managed by : MTQ

- Financing type : Grant

- Amounts granted : Between $10K and $150K

- Main criteria : Subsidies for the purchase of electric buses and the acquisition and installation of charging stations

Sources : EY, Ministère de l’Économie, de la Science et de l’Innovation and Canada Economic Development

PSO – Innov-R

- Managed by : Prompt

- Financing type : Grant

- Amounts granted : Maximum of $200K

- Main criteria : Projects carried out entirely in Quebec and whose resulting intellectual property will be commercialized in Quebec.

- Managed by : Prompt

- Financing type : Grant

- Amounts granted : Not specified / Maximum of 50% of eligible expenses

- Main criteria : Criteria vary depending on the type of project being funded

- Managed by : InnovÉÉ / Prompt

- Financing type : Multiple options

- Amounts granted : Académique: Maximum of $350K / Entreprise: Maximum of $150K

- Main criteria : Collaborative artificial intelligence R&D projects. Maximum 3 years.

Plusieurs programmes de PME MTL

- Managed by : PME MTL

- Financing type : Multiple options

- Amounts granted : Between $15K and $300K

- Main criteria : Minimum private contribution of 20% of eligible expenses for bigger loans + headquartered in Montreal.

Multiple programs of Développement économique de Longueuil

- Managed by : Développement économique Longueuil

- Financing type : Multiple options

- Amounts granted : Between $15K and $250K

- Main criteria : Loans over $100K generally require a minimum private contribution of 20% with collateral.

Multiple programs of Sherbrooke Innopole

- Managed by : Sherbrooke Innopole

- Financing type : Multiple options

- Amounts granted : Between $15K and $250K

- Main criteria : Minimum private contribution of 20% of eligible expenses for bigger loans + headquartered in Sherbrooke.

Multiple programs of Ville de Québec

- Managed by : Ville de Québec

- Financing type : Multiple options

- Amounts granted : Between $15K and $250K

- Main criteria : Criteria vary depending on the type of project being funded and its development stage.

Sources : EY, Ministère de l’Économie, de la Science et de l’Innovation and Canada Economic Development

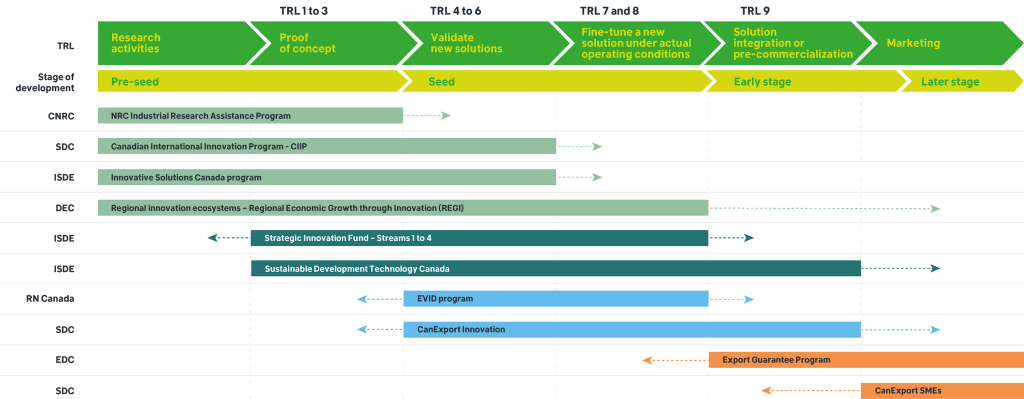

Canadian public funding and grants available to EST businesses

Many federal public funding programs and grants are also available, a number of which are particularly well suited for EST businesses.

The following diagram shows the programs most relevant to the EST sector and indicates the technology readiness level (TRL6) and stage of development7 they address:

6 The different levels of readiness are detailed in the Appendices of the full report

7 The different stages of development are detailed in the Appendices of the full report

*Technology readiness level: system og mesurement used to evaluate the readiness level of a technology.

Details for each program in the above diagram are as follows:

- Managed by : TCS*

- Financing type : Multiple options

- Amounts granted : Maximum of $75K

- Main criteria : Minimum contribution 25% of the project cost

- Managed by : TCS*

- Financing type : Multiple options

- Amounts granted : Maximum of $75K

- Main criteria : Previous year’s sales between $100K and $100 million

- Managed by : CED

- Financing type : Multiple options

- Amounts granted : Not specified

- Main criteria : Company that brings the ecosystem stakeholders together and attracts foreign investment

- Managed by : ISED

- Financing type : Multiple options

- Amounts granted : Minimum of $10 million

- Main criteria : Minimum contribution 25% of the project cost

- Managed by : SDTC

- Financing type : Term loan

- Amounts granted : Between $2 million and $10 million

- Main criteria : Minimum contribution 25% of the project cost

- Managed by : EDC

- Financing type : Loan

- Amounts granted : Not specified

- Main criteria : Not specified

- Managed by : ISED

- Financing type : Grants / Contracts

- Amounts granted : Phase 1: Maximum of $150K / Phase 2: Maximum of $1 million / Phase 3: Flexible

- Main criteria : Have fewer than 500 employees. Be incorporated in Canada. Conduct R&D.

- Managed by : NRC

- Financing type : Multiple options

- Amounts granted : Not specified

- Main criteria : Canadian for-profit SMEs. Have fewer than 500 full-time employees.

- Managed by : TCS*

- Financing type : Multiple options

- Amounts granted : Not specified

- Main criteria : Collaborative R&D projects and international partnerships.

- Managed by : NRCan

- Financing type : Grant

- Amounts granted : Between $300K and $3 million

- Main criteria : Submit proof of income. Have secured a $500K investment. Substantial co-financing from a partner.

*TCS: Global Affairs Canada Trade Commissioner Service

Sources : EY, Ministère de l’Économie et de l’Innovation, Innovation, Sciences et Développement économique Canada

Provincial and federal tax credit and tax incentive programs available to EST businesses

Many tax credit programs are available at both the provincial and federal levels. The following table shows the most relevant programs for Quebec EST businesses.

Québec

- Maximum of 60 consecutive months and applies to the foreign researcher’s salary.

- Not to be confused with the following credit.

- Maximum of 60 consecutive months and applies to the foreign expert’s salary.

- Not to be confused with previous credit.

- Scientific research and experimental development project.

- Tax credit rate between 14% and 30%.

- Tax credit of between 14% and 30% on R&D salaries incurred.

- Reduced tax rate if revenue less than $500K

Canada

- 15% tax credit or 35% non-refundable tax credit on the first $3M of project expenses.

Sources : EY, Ministère de l’Économie, de la Science et de l’Innovation and Canada Economic Development

Lists of foreign funds and investors in the EST sector

Preliminary research and discussions have identified funds interested in assessing investment opportunities or contributing to potential EST-specialized funds in Quebec. Here is a non-exhaustive list of foreign funds / investors partially or entirely focused on the EST sector, deemed relevant, especially at the seed, start-up and post-start-up stages.

Note that certain less EST-relevant Canadian funds have been included on the list given their size and potential value:

- Country : Netherlands

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Germany

- Type of investor : Venture capital fund

- Focus on mobility : Partial

- Country : France / QC

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Canada

- Type of investor : Private equity or venture capital fund

- Focus on mobility : Partial

- Country : Switzerland

- Type of investor : Venture capital fund

- Focus on mobility : Partial

- Country : USA

- Type of investor : Mobility fund

- Focus on mobility : Total

- Country : Austria

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : USA

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Germany

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : USA

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Sweden

- Type of investor : Private equity or venture capital fund

- Focus on mobility : Partial

- Country : USA

- Type of investor : Private equity or venture capital fund

- Focus on mobility : Partial

- Country : USA

- Type of investor : Private equity or venture capital fund

- Focus on mobility : Partial

- Country : Germany

- Type of investor : Private equity or venture capital fund

- Focus on mobility : Partial

- Country : USA

- Type of investor : Mobility fund

- Focus on mobility : Total

- Country : USA

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : USA

- Type of investor : Venture capital fund

- Focus on mobility : Partial

- Country : Canada

- Type of investor : Venture capital fund

- Focus on mobility : Partial

- Country : UK

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Austria

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Israel

- Type of investor : Mobility fund

- Focus on mobility : Total

- Country : USA

- Type of investor : Mobility fund

- Focus on mobility : Total

- Country : USA

- Type of investor : Mobility fund

- Focus on mobility : Total

- Country : Canada

- Type of investor : Venture capital fund

- Focus on mobility : Partial

- Country : Canada

- Type of investor : Private equity or venture capital fund

- Focus on mobility : Partial

- Country : USA

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : UK

- Type of investor : Venture capital fund

- Focus on mobility : Partial

- Country : USA

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Sweden

- Type of investor : Venture capital fund

- Focus on mobility : Total

- Country : Germany

- Type of investor : Venture capital fund

- Focus on mobility : Partial

Source : EY

Additional sources of financing for Québec companies

For more general funding sources available to Quebec businesses, consult the directory updated daily by the Chamber of Commerce of Metropolitan Montreal’s Acclr experts. Each category will redirect you to a customized selection of programs and organizations listed on the Info entrepreneurs site.

Continue reading on the subject

FINANCING | $50 million from Finalta Capital in non-dilutive financing dedicated to the Electric and Smart Transportation sector

Fast growing, innovative companies from the electric and smart transportation (EST) sector in Québec take advantage of the $50 million in funding dedicated to the EST ecosystem by Finalta Capital, one of Canada’s largest funds specialized in non-dilutive tax credit and government grant financing, announced in March 2023 as part of the Impulsion conference, the International EST Summit organized by Propulsion Québec.

Read more

Défis Innovation Québec

The Défis innovation Québec program funds experimental projects by Québec companies with ties to government departments and public bodies in amounts up to $500,000 each.

Read more

The Next Budget Must Ensure Competitiveness of the EST Industry

Montreal, August 3, 2023 — Propulsion Québec, the cluster for Electric and Smart Transportation (EST), submits its priorities in advance of the 2024 federal budget as part of the federal pre-budget consultations process. The global race to attract champions in the electrification sector has begun and Canada must capitalize its strengths to stay competitive.

Read more

Transition+

Tracer la voie aux pionniers québécois pour la transition électrique des transports

Read more

FINANCING | Finalta Capital announces $50 million in non-dilutive financing dedicated to the Electric and Smart Transportation sector

Montreal, March 15, 2023 – As part of the Impulsion conference, the International Electric and Smart Transportation Summit organized by Propulsion Québec, Finalta Capital, one of Canada’s largest funds specialized in non-dilutive tax credit and government grant financing, announces $50 million in funding dedicated to the electric and smart transportation (EST) ecosystem. An enhanced funding […]

Read more

PORTRAIT & BUSINESS OPPORTUNITIES OF THE EST SECTOR IN QUÉBEC | A Status Report on EST and Two Guides to Support Investment in Québec

The Funding group project of Propulsion Québec, the cluster for Electric and Smart Transportation (EST), launched today at IMPULSION, Innovation Edition, the project Portrait & business opportunities of the EST sector in Québec.

Read more

Overview of Québec’s EST Sector & Its Business Opportunities

The completion of the Diagnosis of the Funding Chain in Quebec’s Electric and Smart Transportation (EST) Sector has provided a clear picture of the issues related to financing.

Read more

BUSINESS MODELS AND FINANCING : Attract Investors to the EST Sector

Electric and smart transportation sector (EST) financing is a key element, both for start-ups and well-established organizations. Despite the multitude of economic and environmental opportunities stemming from EST, many investors are unfamiliar with our sector.

Read more